Victorian Homebuyer Fund

During 2020–21, we embarked on a complex program of work to develop systems and processes for the new shared equity initiative, the Victorian Homebuyer Fund. Launching in October 2021, this major part of Victoria’s legislative program for 2021–22 will see eligible people aged over 18 able to work with a lender to buy a house sooner without the burden of saving for a large deposit.

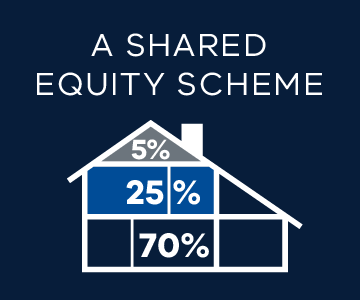

Eligible homebuyers will receive a contribution of up to 25% towards the purchase price of their property, reducing their minimum required deposit to 5% and avoiding the need to pay lenders mortgage insurance.

For eligible Aboriginal or Torres Strait Islander homebuyers, this contribution is up to 35% and the minimum required deposit is 3.5%.

The Victorian Government’s financial contribution to the fund is made in exchange for a share, or proportional interest, in the buyer’s property.

As the value of the property changes, so too will the value of the state’s contribution, meaning the Homebuyer Fund will share in any gains in the property’s value.

Pensioner exemptions and concessions

This year, 5637 pensioners (5994 in 2019-20) accessed the specific exemptions and concessions available to them to buy their own homes, totalling $62 million ($64.5 million last year) in combined savings.

Concessions for homes

The principal place of residence (PPR) concession supports Victorians who buy their own home. This concession is available to those buying a property valued up to $550,000 and who move into their home within 12 months of settlement.

The total number of concessions this year increased by 10,089 from 2019–20, and garnered total savings for our customers of $130.5 million.

Principal place of residence concessions 2020-21

| Number | Value ($m) | |

|---|---|---|

| Metropolitan Melbourne | 36,379 | 80.4 |

| Regional Victoria | 27,398 | 50.1 |

| TOTAL | 63,777 | 130.5 |